As President Trump nears his 100th day in office, the initial optimism that greeted his bold economic agenda has given way to growing public unease. A combination of escalating tariffs, volatile markets and mixed signals from Washington has driven consumer sentiment to levels not seen since early 2022. With long-term inflation expectations climbing above 4%, households across the country are bracing for the prospect of sustained price pressures that could significantly curb discretionary spending in the months ahead.

Meanwhile, financial markets have served as a stark barometer of national mood. The S&P 500’s slide—more than 10% below its February peak—reflects investor jitters over trade tensions and doubts about the resilience of U.S. growth under an unpredictable policy regime. Even “safe-haven” U.S. Treasuries experienced an unusual sell-off, a rare signal that confidence in American stability itself is fraying rather than simply appetite for risk.

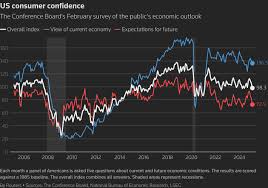

Consumer Sentiment Hits Troubling Lows

Escalating trade disputes have taken a clear toll on the pulse of the average American. The University of Michigan’s consumer sentiment index now hovers near its lowest point since 2022, underscoring a shift in mood that transcends traditional partisan divides. From households worried about higher grocery bills to those delaying big-ticket purchases, the prospect of steeper tariffs has left many feeling exposed.

Rising long-term inflation expectations—ratcheting above 4%—have deepened these concerns. As consumers anticipate sustained price increases, they are tightening their budgets, shelving major appliances and postponing travel. Economists warn that once sentiment sours, it can set off a feedback loop: reduced spending undermines business confidence, leading to slower hiring and investment.

Wall Street’s recent correction has been swift and unforgiving. The benchmark S&P 500 index slipped more than 10% from its February highs as investors grappled with the uncertainty born of broadening tariff threats. Industries reliant on global supply chains—from technology to auto manufacturing—have been particularly hard hit, with share prices retreating in anticipation of higher costs and potential retaliation.

Bond markets have contributed a surprising twist to the story. U.S. Treasuries—typically a refuge during times of market stress—saw yields rise as foreign and domestic holders offloaded government debt. This atypical “risk-on” behavior in the bond market points to a deeper erosion of faith in America’s economic trajectory, rather than a simple reweighting of portfolios.

Unsteady Policy Stance Raises Eyebrows

Surveys reveal that more than half of Americans now view the administration’s economic decisions as “too erratic.” Sudden declarations of new tariffs, paired with overt pressure on the Federal Reserve, have fueled a perception of unpredictable governance. Markets and moderate voters alike have balked at the prospect of presidential interference in central bank affairs—a move seen as a threat to a cornerstone of economic stability.

The rapid-fire nature of announcements—from auto imports to Chinese goods—has left businesses struggling to plan. CEOs report that shifting targets and abrupt deadlines complicate supply-chain contracts and investment timelines. In an environment where policy could pivot overnight, many firms are choosing caution over expansion, delaying hiring and capex decisions until a clearer playbook emerges.

History offers a cautionary tale for presidents whose economic approval dips below the 50% mark in the months preceding midterms or primaries. Sub-50% ratings have often presaged losses for the incumbent party in Congress—a dynamic that Republicans know all too well as they brace for off-year elections. Political strategists warn that slipping economic confidence may translate directly into ballot-box punishments.

Alarmingly for the White House, even staunch Republican voters are beginning to voice unease. Recent polling shows that roughly one in four self-identified Republicans now believes the cost of living is on the wrong track. While party loyalty remains strong, these fissures hint at potential fractures that could widen if economic indicators continue to disappoint.

Strains on Social Security Stir Public Fears

The financial health of Social Security has emerged as a focal point of national anxiety. Three-quarters of adults express concern over the program’s solvency, linking broader economic unease to worries about retirement security. As households entertain the prospect of diminished benefits or funding reforms, the social safety net—once considered sacrosanct—feels perilously close to political crosshairs.

Discussion of trimming benefits or raising the retirement age, quietly advanced by some within the administration, risks igniting fierce backlash. Analysts caution that any proposal to shrink the program could become a potent rallying cry for activists and senior voters, compounding political fallout amid an already fraught economic climate.

Tariff Measures Under Fire for Pushing Prices Higher

Critics argue that sweeping tariff hikes may have become cover for corporate pricing strategies that go beyond genuine cost increases. Dubbed “greedflation,” this phenomenon sees firms using the political cover of elevated import duties to ratchet up consumer prices, squeezing household budgets even further. Consumer advocates warn that without close oversight, tariffs could become a hidden tax on every purchase.

Policymakers face a delicate balancing act: safeguarding domestic industries from unfair competition while preventing opportunistic price gouging. Some propose targeted tariffs—focusing on specific goods or sectors—as a middle path, but such an approach risks undercutting the administration’s broader “America First” trade narrative.

Official unemployment figures remain relatively healthy—around 4.2%—yet many Americans report lingering fears over job security and income growth. This disconnect suggests that headline labor statistics no longer paint the full picture of household economic reality. Temporary layoffs, hiring freezes and contract cutbacks have proliferated in key sectors, sapping the confidence of workers even when payroll numbers appear robust.

Manufacturing and technology firms, once engines of employment gains, have led the wave of cautious retrenchment. Workers in these industries report increased volatility in hours and project allocations, fostering a sense that the next downturn could hit even before overall growth indicators soften.

Warnings from Global Economies Mount

Major international organizations and credit agencies have trimmed U.S. growth forecasts for the year, citing the disruptive effects of trade decoupling on export-dependent industries and supply chains. Economies in Europe and Asia are watching closely, as the fallout from tit-for-tat tariffs threatens to ripple outward, undermining global demand for American goods and services.

Retaliatory levies by trading partners pose a particular threat to U.S. agriculture and manufacturing. Farmers face the specter of foreign tariffs on soybeans and corn, while exporters of machinery and aircraft confront new obstacles abroad. These pressures combine to exacerbate regional economic stress, hitting rural communities and industrial heartlands especially hard.

The Federal Reserve’s decision to hold interest rates steady—despite short-term inflationary blips tied to trade costs—reflects a commitment to long-term price stability. Yet this “cruel-to-be-kind” strategy risks tipping the economy into a sharper contraction if growth stalls more abruptly than expected. Businesses and consumers could find borrowing costs remaining elevated even as demand softens.

Adding to the uncertainty, cracks are emerging within the Fed itself. A divergence of views among policymakers on the timing and magnitude of future rate moves has injected fresh volatility into markets. As investors parse every Fed statement for clues, even minor disagreements among governors can spark outsized reactions in bond and equity markets, further complicating an already fraught economic landscape.

With consumer mood at its nadir, financial markets unsettled, and policy surrounded by controversy, the stakes for the administration have rarely been higher. How the White House navigates these headwinds will not only shape the near-term economic trajectory but also determine the political capital available for its agenda in the crucial months ahead.

(Source:www.reuters.com)

Meanwhile, financial markets have served as a stark barometer of national mood. The S&P 500’s slide—more than 10% below its February peak—reflects investor jitters over trade tensions and doubts about the resilience of U.S. growth under an unpredictable policy regime. Even “safe-haven” U.S. Treasuries experienced an unusual sell-off, a rare signal that confidence in American stability itself is fraying rather than simply appetite for risk.

Consumer Sentiment Hits Troubling Lows

Escalating trade disputes have taken a clear toll on the pulse of the average American. The University of Michigan’s consumer sentiment index now hovers near its lowest point since 2022, underscoring a shift in mood that transcends traditional partisan divides. From households worried about higher grocery bills to those delaying big-ticket purchases, the prospect of steeper tariffs has left many feeling exposed.

Rising long-term inflation expectations—ratcheting above 4%—have deepened these concerns. As consumers anticipate sustained price increases, they are tightening their budgets, shelving major appliances and postponing travel. Economists warn that once sentiment sours, it can set off a feedback loop: reduced spending undermines business confidence, leading to slower hiring and investment.

Wall Street’s recent correction has been swift and unforgiving. The benchmark S&P 500 index slipped more than 10% from its February highs as investors grappled with the uncertainty born of broadening tariff threats. Industries reliant on global supply chains—from technology to auto manufacturing—have been particularly hard hit, with share prices retreating in anticipation of higher costs and potential retaliation.

Bond markets have contributed a surprising twist to the story. U.S. Treasuries—typically a refuge during times of market stress—saw yields rise as foreign and domestic holders offloaded government debt. This atypical “risk-on” behavior in the bond market points to a deeper erosion of faith in America’s economic trajectory, rather than a simple reweighting of portfolios.

Unsteady Policy Stance Raises Eyebrows

Surveys reveal that more than half of Americans now view the administration’s economic decisions as “too erratic.” Sudden declarations of new tariffs, paired with overt pressure on the Federal Reserve, have fueled a perception of unpredictable governance. Markets and moderate voters alike have balked at the prospect of presidential interference in central bank affairs—a move seen as a threat to a cornerstone of economic stability.

The rapid-fire nature of announcements—from auto imports to Chinese goods—has left businesses struggling to plan. CEOs report that shifting targets and abrupt deadlines complicate supply-chain contracts and investment timelines. In an environment where policy could pivot overnight, many firms are choosing caution over expansion, delaying hiring and capex decisions until a clearer playbook emerges.

History offers a cautionary tale for presidents whose economic approval dips below the 50% mark in the months preceding midterms or primaries. Sub-50% ratings have often presaged losses for the incumbent party in Congress—a dynamic that Republicans know all too well as they brace for off-year elections. Political strategists warn that slipping economic confidence may translate directly into ballot-box punishments.

Alarmingly for the White House, even staunch Republican voters are beginning to voice unease. Recent polling shows that roughly one in four self-identified Republicans now believes the cost of living is on the wrong track. While party loyalty remains strong, these fissures hint at potential fractures that could widen if economic indicators continue to disappoint.

Strains on Social Security Stir Public Fears

The financial health of Social Security has emerged as a focal point of national anxiety. Three-quarters of adults express concern over the program’s solvency, linking broader economic unease to worries about retirement security. As households entertain the prospect of diminished benefits or funding reforms, the social safety net—once considered sacrosanct—feels perilously close to political crosshairs.

Discussion of trimming benefits or raising the retirement age, quietly advanced by some within the administration, risks igniting fierce backlash. Analysts caution that any proposal to shrink the program could become a potent rallying cry for activists and senior voters, compounding political fallout amid an already fraught economic climate.

Tariff Measures Under Fire for Pushing Prices Higher

Critics argue that sweeping tariff hikes may have become cover for corporate pricing strategies that go beyond genuine cost increases. Dubbed “greedflation,” this phenomenon sees firms using the political cover of elevated import duties to ratchet up consumer prices, squeezing household budgets even further. Consumer advocates warn that without close oversight, tariffs could become a hidden tax on every purchase.

Policymakers face a delicate balancing act: safeguarding domestic industries from unfair competition while preventing opportunistic price gouging. Some propose targeted tariffs—focusing on specific goods or sectors—as a middle path, but such an approach risks undercutting the administration’s broader “America First” trade narrative.

Official unemployment figures remain relatively healthy—around 4.2%—yet many Americans report lingering fears over job security and income growth. This disconnect suggests that headline labor statistics no longer paint the full picture of household economic reality. Temporary layoffs, hiring freezes and contract cutbacks have proliferated in key sectors, sapping the confidence of workers even when payroll numbers appear robust.

Manufacturing and technology firms, once engines of employment gains, have led the wave of cautious retrenchment. Workers in these industries report increased volatility in hours and project allocations, fostering a sense that the next downturn could hit even before overall growth indicators soften.

Warnings from Global Economies Mount

Major international organizations and credit agencies have trimmed U.S. growth forecasts for the year, citing the disruptive effects of trade decoupling on export-dependent industries and supply chains. Economies in Europe and Asia are watching closely, as the fallout from tit-for-tat tariffs threatens to ripple outward, undermining global demand for American goods and services.

Retaliatory levies by trading partners pose a particular threat to U.S. agriculture and manufacturing. Farmers face the specter of foreign tariffs on soybeans and corn, while exporters of machinery and aircraft confront new obstacles abroad. These pressures combine to exacerbate regional economic stress, hitting rural communities and industrial heartlands especially hard.

The Federal Reserve’s decision to hold interest rates steady—despite short-term inflationary blips tied to trade costs—reflects a commitment to long-term price stability. Yet this “cruel-to-be-kind” strategy risks tipping the economy into a sharper contraction if growth stalls more abruptly than expected. Businesses and consumers could find borrowing costs remaining elevated even as demand softens.

Adding to the uncertainty, cracks are emerging within the Fed itself. A divergence of views among policymakers on the timing and magnitude of future rate moves has injected fresh volatility into markets. As investors parse every Fed statement for clues, even minor disagreements among governors can spark outsized reactions in bond and equity markets, further complicating an already fraught economic landscape.

With consumer mood at its nadir, financial markets unsettled, and policy surrounded by controversy, the stakes for the administration have rarely been higher. How the White House navigates these headwinds will not only shape the near-term economic trajectory but also determine the political capital available for its agenda in the crucial months ahead.

(Source:www.reuters.com)