Despite cessation of publication of data on the consumer price index (CPI), its growth is widely viewed in tripartite terms. This is facilitated by the disintegrating socialist system in which many people are trying to get food and medicine.

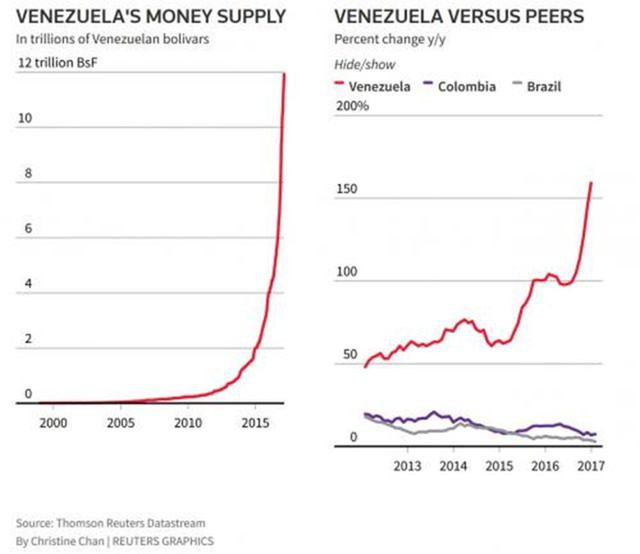

According to the central bank, the M2 money supply grew almost 180% in mid-February compared to the same period last year, before the regulator stopped publishing weekly data without explanation, Reuters reported. The agency noted that the money supply in the neighboring Venezuela of Colombia grew by 7% over the same period, and by 6% - in the USA.

"If they do not publish (data), you know, they should be growing rapidly," said Aurelio Concheso, director of consulting firm Aspen Consulting in Caracas. Reuters reports that the Central Bank and the Ministry of Communications of Venezuela did not respond to a request for comment.

The increase in M2, the amount of cash along with checks, savings and other deposits, means that more currency is circulating in the country now. This can accelerate inflation coupled with a decline in the volume of production of goods and services.

When the money supply grows exponentially, as it was in Venezuela, scientists usually point to infamous example of the Weimar Republic in Germany (1919-1933) and are limiting themselves with this.

Slowly, but surely, Venezuela stopped publishing all the economic data. In addition to the money supply and the consumer price index, the government stopped distributing data on gross domestic product (GDP) more than a year ago. Prior to this, the authorities stopped issuing indicators of the balance of payments and the deficit index of consumer goods.

For those who are somehow unfamiliar with this, the money supply of Venezuela, measured by the M2 index, has been climbing up exponentially, since Hugo Chavez, an ardent socialist, came to power in 1999. This indicator is the main factor determining the highest inflation in the world.

source: reuters.com

According to the central bank, the M2 money supply grew almost 180% in mid-February compared to the same period last year, before the regulator stopped publishing weekly data without explanation, Reuters reported. The agency noted that the money supply in the neighboring Venezuela of Colombia grew by 7% over the same period, and by 6% - in the USA.

"If they do not publish (data), you know, they should be growing rapidly," said Aurelio Concheso, director of consulting firm Aspen Consulting in Caracas. Reuters reports that the Central Bank and the Ministry of Communications of Venezuela did not respond to a request for comment.

The increase in M2, the amount of cash along with checks, savings and other deposits, means that more currency is circulating in the country now. This can accelerate inflation coupled with a decline in the volume of production of goods and services.

When the money supply grows exponentially, as it was in Venezuela, scientists usually point to infamous example of the Weimar Republic in Germany (1919-1933) and are limiting themselves with this.

Slowly, but surely, Venezuela stopped publishing all the economic data. In addition to the money supply and the consumer price index, the government stopped distributing data on gross domestic product (GDP) more than a year ago. Prior to this, the authorities stopped issuing indicators of the balance of payments and the deficit index of consumer goods.

For those who are somehow unfamiliar with this, the money supply of Venezuela, measured by the M2 index, has been climbing up exponentially, since Hugo Chavez, an ardent socialist, came to power in 1999. This indicator is the main factor determining the highest inflation in the world.

source: reuters.com