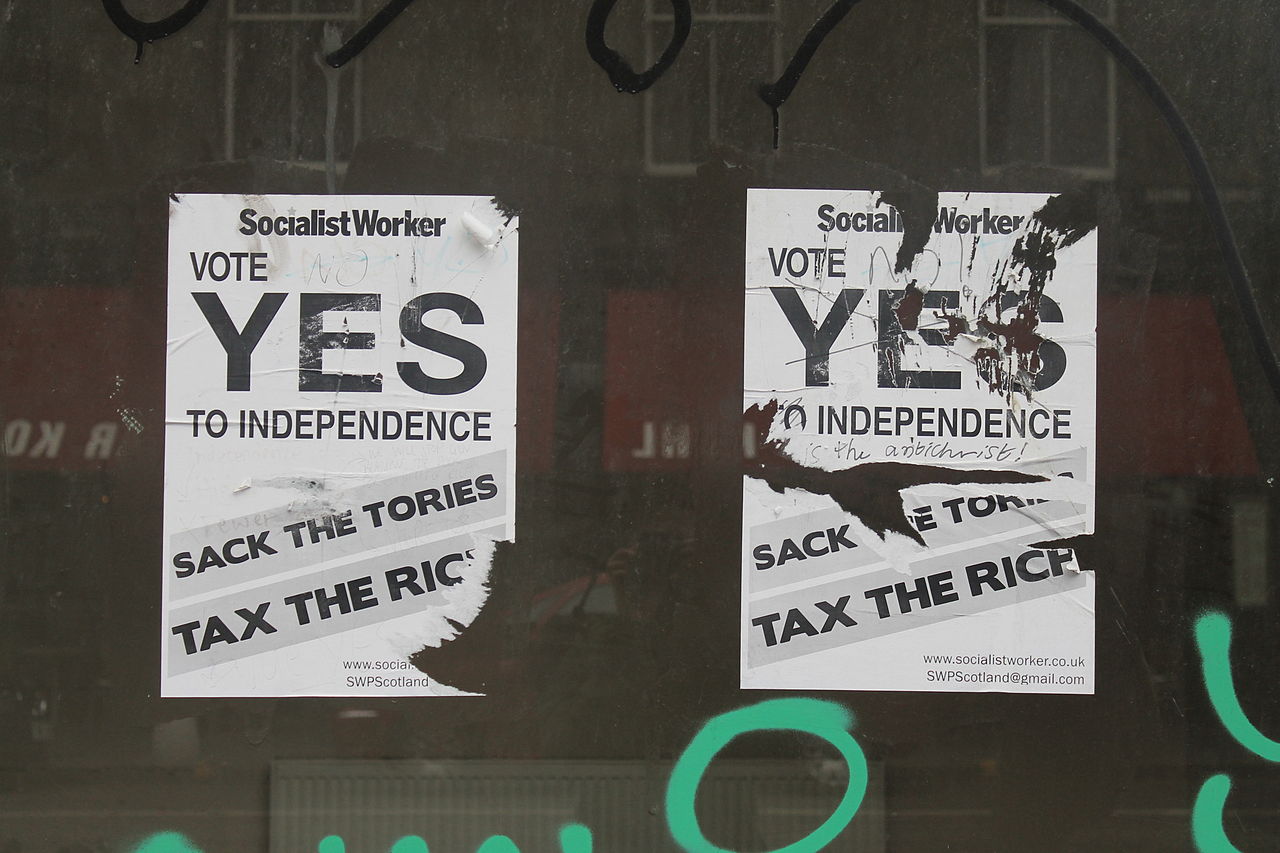

The pound fell by 0.6% after Times, citing unnamed sources in the government, said that May can agree on a new vote in Scotland on condition that it will held after release of the UK from the European Union. In September 2014, 55% of Scots voted to remain part of the UK, while 45% voted "against".

Previously Charles Grant, an adviser to the Scottish government's Standing Council on Europe said that the Scottish Government intends to once again hold a referendum on the region's independence. However, the vote could take place only in next year.

The House of Lords on Monday is also beginning a detailed consideration of the bill, which will allow May to start Brexit procedure.

"If the market is seriously thinking that another referendum on independence may be held soon, remember how deep the pound fell in early September 2014, before the previous referendum. Memory of this can quite easily cause sale of the pound." - said Ray Attrill, Global Co-Head of FX Strategy at National Australia Bank.

"It seems unlikely that Westminster would agree on another referendum in the near future, - said Sean Callow, a senior strategist at Westpac in Sydney. - I would not be surprised if the GBP/USD pair returned to the level above 1.2450 in trading in London. "

In early February, the British Defense Secretary Michael Fallon said in an interview with BBC Radio Scotland that the UK government can block a second referendum on Scottish independence.

Fallon said that if Sturgeon "constantly calls to respect the Scottish National Party, then she must respect decision of Scotland to remain in the UK in 2014 and the decision of the UK to leave the EU." "Respect is a two-way process", - he stressed.

Scottish independence would carry greater threat to the fast-growing financial services sector in Scotland than Brexit, stated the University of Strathclyde in November 2016. Former RBS chief economist Jeremy Peat and Head of Scottish Financial Enterprise Owen Kelly warned the independence could cause even more uncertainty than even Brexit.

"Almost every provider of financial services in Scotland serves the UK market, not the EU market, so impact of this separation will be very serious", - the report says.

During the referendum in June, the majority of Scots voted to stay in the EU, and the First Minister of Scotland Nicola Sturgeon called for a second referendum on Scottish independence, arguing that Brexit is an existential threat to the country's economy.

However, Peat and Kelly in their report "BREXIT and the Scottish Financial Services Sector" note that Brexit "does not take into account for possibility of Scotland's independence for the EU."

They emphasize importance of maintaining the UK’s financial passport after Brexit. Without this, the UK companies in the sector would not be able to conduct free trade in the single market through local licenses.

Yet, even if the United Kingdom does lose its right to certification, risks to the Scottish financial sector in in relations with the rest of the UK will be as large as risks after the "hard Brexit, in which Scotland remains within the United Kingdom."

source: bloomberg.com, reuters.com

Previously Charles Grant, an adviser to the Scottish government's Standing Council on Europe said that the Scottish Government intends to once again hold a referendum on the region's independence. However, the vote could take place only in next year.

The House of Lords on Monday is also beginning a detailed consideration of the bill, which will allow May to start Brexit procedure.

"If the market is seriously thinking that another referendum on independence may be held soon, remember how deep the pound fell in early September 2014, before the previous referendum. Memory of this can quite easily cause sale of the pound." - said Ray Attrill, Global Co-Head of FX Strategy at National Australia Bank.

"It seems unlikely that Westminster would agree on another referendum in the near future, - said Sean Callow, a senior strategist at Westpac in Sydney. - I would not be surprised if the GBP/USD pair returned to the level above 1.2450 in trading in London. "

In early February, the British Defense Secretary Michael Fallon said in an interview with BBC Radio Scotland that the UK government can block a second referendum on Scottish independence.

Fallon said that if Sturgeon "constantly calls to respect the Scottish National Party, then she must respect decision of Scotland to remain in the UK in 2014 and the decision of the UK to leave the EU." "Respect is a two-way process", - he stressed.

Scottish independence would carry greater threat to the fast-growing financial services sector in Scotland than Brexit, stated the University of Strathclyde in November 2016. Former RBS chief economist Jeremy Peat and Head of Scottish Financial Enterprise Owen Kelly warned the independence could cause even more uncertainty than even Brexit.

"Almost every provider of financial services in Scotland serves the UK market, not the EU market, so impact of this separation will be very serious", - the report says.

During the referendum in June, the majority of Scots voted to stay in the EU, and the First Minister of Scotland Nicola Sturgeon called for a second referendum on Scottish independence, arguing that Brexit is an existential threat to the country's economy.

However, Peat and Kelly in their report "BREXIT and the Scottish Financial Services Sector" note that Brexit "does not take into account for possibility of Scotland's independence for the EU."

They emphasize importance of maintaining the UK’s financial passport after Brexit. Without this, the UK companies in the sector would not be able to conduct free trade in the single market through local licenses.

Yet, even if the United Kingdom does lose its right to certification, risks to the Scottish financial sector in in relations with the rest of the UK will be as large as risks after the "hard Brexit, in which Scotland remains within the United Kingdom."

source: bloomberg.com, reuters.com